Best Buyer Intent Data Predicts B2B Purchase

By b2b sales, b2b tactics, buyer motivation, abm

It's the ultimate question in sales and marketing. There are a plethora of tools, data pieces, and prediction models available.

We reviewed DiscoverOrg’s survey regarding the ABM predictive buyer and here is what we found out:

7 IMPORTANT FINDINGS TO UNDERSTAND PREDICTIVE ABM BUYER

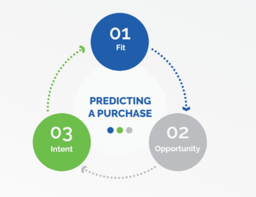

- Fit, Intent, and Opportunity are three sorts of predictive data that come together to create buying magic.

- When predictive signs are present, 95% of all respondents see positive income benefits, with increased conversion rates being the most prevalent advantage.

- Despite the fact that most firms do not use Intent or Opportunity data, these data points are at the top of the "most predictive" leaderboard.

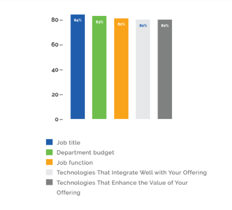

- Job title and Department budget are the most predictive Fit data elements.

- Marketing teams place a lower weight on hiring and personnel signals than sales teams.

- The "secret sauce" prediction formulas include knowing your prospect's tech stack.

- Only 20% of respondents utilize predictive data to support their ABM initiatives, despite the hype.

Let's take a closer look at each of these results.

FINDING 1: Fit, Intent, and Opportunity are three sorts of predictive data that come together to create buying magic

Only when behavioral data is paired with well-defined firmographic and demographic characteristics that match the Ideal Customer Profile can it be used to forecast future behavior.

The proper contact (at the right firm) must meet the following criteria: Any type of scoring or predictive analysis requires a fully defined corporate profile as a prerequisite. All of the other data, no matter how accurate it is at forecasting, is useless if the firm isn't a good match.

Contact data elements such as Title, Department, Job Role, and Job Level are also included in the fit criterion. A salesforce is likely to spin a lot of cycles on offers that don't end up closing without an Ideal Customer Profile that touches on these topics, as well as fit requirements at the organization level.

Opportunity Insights (Favorable conditions): A prospect may come upon a solution at just the right time. But luck has never been a smart sales approach; that's why when opportunity or "trigger" data is stacked on top of Fit and Intent data, it becomes a fully predictive element of the purchase equation.

These are the data points that show that the time is right for a change.

Intent (Implicit behavior): With a foundation of fundamental demographic and firmographic facts in place, as well as favorable conditions, purpose data becomes extremely valuable for forecasting success. The behavioral activity that connects target buyers and accounts to a solution, solution category, or related subjects is known as intent data.

Form fills, content downloads, event registrations, page views, duration on page, number of visitors from an account, and other digital footprints are examples of intent data.

FINDING 2: When predictive signs are present, 95% of all respondents see positive income benefits, with increased conversion rates being the most prevalent advantage.

In general, it is evident that predictive data is important. Only 5% of respondents indicated there was no relationship between positive sales outcomes and the availability of predictive indicators (we have so many questions for that 5%! ), implying that 95% of respondents were able to link growth to predictive indicators. Higher conversion rates of the prospect to qualified lead are frequently the most beneficial result with the strongest correlation. Surprisingly, no other good outcome (such as faster sales cycles, more wins, better sales price, or more demos) was mentioned in the majority of respondents.

Join our free event here and dive into B2B Marketing and B2B Digital Marketing Strategies regarding Channel Performance.

This most likely indicates a couple of crucial conclusions for sales teams:

- Many businesses are unable to trace the impact of these predictive indications all the way through the sales funnel, and technology is ineffective in delivering these insights.

- Predictive indications will get you a foot in the door, maybe even allowing you to get there first, but they will not sell your product for you. Just though a buyer appears to be your greatest customer and is eager to acquire a solution like yours doesn't imply they'll pick you as their vendor in the end; you must always put your best foot forward.

FINDING 3: Despite the fact that most firms do not use Intent or Opportunity data, these data points are at the top of the "most predictive" leader board.

The top four most predictive individual data points belong to the Intent category and are focused on purchasers' online research behavior - however, the majority of businesses have yet to invest in this information.

The next two most predictive individual data pieces are Opportunity-related, such as detecting RFPs and planned projects/initiatives that may or may not be accompanied by a publicly published RFP (they generally aren't).

Companies utilize the least opportunity-related data, despite the fact that having access to these two data points might help you gain a seat at the table - and if the data isn't publicly available, you'll get the first seat.

FINDING 4: Job title and Department budget are the most predictive Fit data elements.

Fit criteria are the primary layer of data for evaluating prospects and accounts - basic physiological data that serves as the base for Maslow's Hierarchy of Needs for sales and marketing. If the fundamentals aren't in place – for example, selling to the incorrect department or to a department with no funding – the sale becomes an extraordinarily difficult mountain to scale.

The buyers' technology profile, which includes technologies that connect with the seller's offering and technologies that complement the seller's offering, is the other most predictive match factor. Technology characteristics are so significant that they make up four of the top seven most predictive data points.

FINDING 5: Marketing teams place a lower weight on hiring and personnel signals than sales teams.

Every day, the sales agent is on the phone, seeking to set up a meeting or clinch a transaction with real people. When a prospect quits their employment, they must connect with someone else inside the business, or their opportunity will be lost. On the other hand, as soon as a crucial function is filled, the sales professional has the opportunity to interact and connect with their new prospect.

This creates a significant potential for marketing teams to better exploit data related to staff transfers. When a target account announces significant recruiting plans or a new leader in a key role, it's a good opportunity to start marketing and raising brand awareness.

How many marketing teams are leveraging this signal to send a direct mail piece to a new executive or increase targeted advertising to fast-growing firms with major recruiting ambitions, for example? Probably not as many as they ought to be.

FINDING 6: The "secret sauce" prediction formulas include knowing your prospect's tech stack.

This may appear to show a lack of coordination between sales and marketing, but it is more likely to emphasize the varied roles of sales and marketing in the buying process. Sales teams are focused on accounts with the capacity to purchase right now, whereas marketing is focused on discovering prospects at the top of the funnel who exhibit early intent.

On the other side, it might signal that not enough marketing teams are concentrating on (or even collecting) basic Fit criteria, or explicitly targeting and enticing prospects that fit that Ideal Customer Profile. As a result, marketing-sales alignment, lead quality, and funnel conversion rates will all increase.

FINDING 7: Only 20% of respondents utilize predictive data to support their ABM initiatives, despite the hype.

We asked respondents to list all of the numerous ways they use the predictive data they collect; thankfully, the majority are utilizing the data to make their sales and marketing operations smarter and more focused.

Despite the excitement around account-based marketing (ABM), few companies are really adopting ABM programs. Only 20% of respondents have adopted an ABM strategy, and only 30% rate their customers and leads based on their potential to buy.

Even more discouraging, just 28% of DiscoverOrg’s survey respondents said they use the data they acquire to cleanse or remove bad data from their systems. What happens if database health isn't prioritized? More data is coming in, more data is going bad, and more teams are feeling overwhelmed by how to make choices with all of that data, whether for ABM or not. Worse still, the decisions they do make may not always be the best ones.

CONCLUSION

Purchases are made at the intersection of accurate Fit, Intent, and Opportunity data, and the winning sales and marketing teams are those that combine this data to identify, prioritize, and monitor their target accounts and contacts, allowing them to reach out at the right time with the right message to the right person.

If you'd like to see how NNC's award-winning sales and marketing intelligence platform uses precise Fit, Intent, and Opportunity data to assist sales and marketing teams to find, prioritize, and effectively anticipate accounts most likely to purchase, schedule a demo now.

Latest Posts

Categories

- B2B Marketing (194)

- blog (147)

- Social media marketing (69)

- social media (53)

- Digital Marketing (43)

- Marketing (42)

- Lead Generation (39)

- Marketing Strategy (35)

- Lead Generation (33)

- B2B (30)

- Press releases (27)

- Behind the Scenes (26)

- marketing automation (26)

- Content Marketing (25)

- Marketing (21)

- Strategy (21)

- b2b tactics (19)

- AI (18)

- AI Marketing (18)

- b2b business objectives (17)

- online marketing (17)

- SEO (16)

- content marketing (15)

- B2B Campaigns (14)

- Business Growth (14)

- Business continuity (14)

- google ads (14)

- B2B Blogging (13)

- B2B business (13)

- PR Communication (13)

- b2b lead generation (13)

- PPC (12)

- b2b strategy (12)

- Marketing News (11)

- Marketing Planning (11)

- Social Media Strategy (11)

- marketing tips (11)

- B2B PPC Campaign (10)

- Conversion Rate (10)

- Employer Branding (10)

- Marketing Automation Tool (10)

- b2b social media (10)

- White papers (9)

- artificial intelligence marketing (9)

- inbound marketing (9)

- B2B companies (8)

- B2B email marketing (8)

- Fractional CMO (8)

- Twitter (8)

- crisis management (8)

- marketing automation for B2B businesses (8)

- online PR (8)

- ABM Strategy (7)

- E-books (7)

- Email Marketing (7)

- Facebook (7)

- HubSpot (7)

- Pinterest (7)

- SEO trends (7)

- b2b sales (7)

- content strategy (7)

- marketing plan (7)

- social networks (7)

- Business Development (6)

- CMO (6)

- Lead Generation Trends (6)

- Marketing Trends (6)

- SEO Strategies for B2B Companies (6)

- Webinar Recording (6)

- artificial intelligence (6)

- marketing objectives in b2b (6)

- sales prospecting (6)

- social media marketing campaign (6)

- social media trends (6)

- technology marketing (6)

- Business Intelligence (5)

- Digital Transformation (5)

- Events (5)

- Facebook page (5)

- Google AdWords (5)

- IT (5)

- Instagram (5)

- KPI measurements (5)

- Landing Page (5)

- LinkedIn (5)

- LinkedIn marketing strategy (5)

- Marketing Management (5)

- Video Content (5)

- automated marketing (5)

- b2b best practices (5)

- b2b prospecting (5)

- b2b strategies (5)

- digital communication strategy (5)

- internationalisation (5)

- marketing automation systems (5)

- trends (5)

- B2B marketing campaigns (4)

- B2B marketing inbound (4)

- Business Strategy (4)

- Cost per Lead (4)

- Digital Influence (4)

- HubSpot Certified Agency (4)

- NNC Services (4)

- Paid Advertising (4)

- Tech Startup (4)

- Tech Startup Marketing Strategy (4)

- Uncategorized (4)

- Video Marketing Strategy (4)

- b2b sales plan (4)

- best practices during crisis (4)

- brand engagement (4)

- leading marketing automation tools (4)

- market entry (4)

- marketing content (4)

- personal branding (4)

- proactive marketing (4)

- ABM sales outreach (3)

- Agile Marketing (3)

- B2B Email Marketing Campaigns (3)

- B2B Marketing Budget (3)

- B2B digital agency (3)

- B2B marketing strategy inbound (3)

- Conversion Rate Optimization (3)

- Financial (3)

- Google Analytics (3)

- Google+ (3)

- Internal Marketing (3)

- Lead Gen Automation Tools (3)

- Linkedin Groups (3)

- Marketing Automation Migration (3)

- Online Events (3)

- Pardot (3)

- Pardot to HubSpot Migration (3)

- Product Marketing (3)

- SMB international Business Models (3)

- Search Engine Optimization (3)

- Tech (3)

- Webinar (3)

- abm (3)

- b2b blogging (3)

- b2b customer aquisition (3)

- b2b growth (3)

- barriers to entry (3)

- blogging (3)

- business plan (3)

- buyer persona (3)

- customer research (3)

- demand generation (3)

- doing business abroad (3)

- employer brand (3)

- employer branding strategy (3)

- inbound leads (3)

- marketing audit (3)

- marketing automation strategy (3)

- marketing leadership (3)

- marketing portfolio audit (3)

- omnichannel marketing (3)

- online communities (3)

- online demand (3)

- outsourcing (3)

- prospects (3)

- storytelling (3)

- tech business (3)

- visual content (3)

- website optimization (3)

- 4P’s (2)

- B2B Contacts (2)

- B2B Marketing Collaterals (2)

- B2B presentations (2)

- Channel Integration (2)

- Customer-Centric (2)

- DIY business (2)

- E-Commerce (2)

- Facebook content (2)

- Go-to-Market Strategies (2)

- Hubspot Inbound (2)

- Hubspot Portal audit (2)

- Hubspot marketing portal (2)

- IT recruitment (2)

- Innovation (2)

- Integrated Marketing (2)

- Internship (2)

- Marketing Metrics (2)

- Microsoft Dynamics (2)

- PPT (2)

- Pay-per-Click (2)

- ROI (2)

- RevOps (2)

- SMART (2)

- SMB (2)

- SME (2)

- Sales Automation (2)

- Sales Automation Tools (2)

- Salesforce (2)

- Telemarketing (2)

- Tumblr (2)

- action plan (2)

- b2b planning (2)

- b2b tradeshow (2)

- b2b video marketing (2)

- banking (2)

- business communities (2)

- business management (2)

- buyer journey (2)

- buyer motivation (2)

- celebrities (2)

- client presentations (2)

- company marketing (2)

- company presentation rules (2)

- context marketing (2)

- conversion tracking (2)

- copywriting (2)

- corporate presentations (2)

- data driven (2)

- eCommerce Marketing (2)

- employee value proposition (2)

- employer value proposition (2)

- entertainment industry (2)

- entrepreneurs (2)

- free marketing tools (2)

- fundraising (2)

- gdpr (2)

- how to present in front of customers (2)

- how to write a presentation (2)

- marketing investing (2)

- marketing outsourcing (2)

- marketing segmentation (2)

- marketing upskilling (2)

- networking communities (2)

- nonprofits (2)

- online strategies (2)

- outbound marketing (2)

- outsourced marketing (2)

- ppc ads (2)

- ppc management (2)

- ppc strategy (2)

- presentation structure (2)

- product audit (2)

- product portfolio (2)

- promotion (2)

- sales enablement (2)

- sales funnel (2)

- segmentation (2)

- service marketing (2)

- slideshows (2)

- social platform (2)

- succes management (2)

- supporters (2)

- targeting (2)

- tourism industry (2)

- tradeshow attendance (2)

- tradeshow objectives (2)

- tradeshow results (2)

- tradeshow strategy (2)

- webinar tips (2)

- 2014 (1)

- ActiveCampaign (1)

- Ad Rank (1)

- AdidasOriginal (1)

- Android (1)

- B2B Case Study (1)

- B2B Digital Training (1)

- B2B SaaS startup strategy (1)

- B2B SaaS success factors (1)

- B2B content marketing trends (1)

- B2B e-mail copy (1)

- B2B e-mail marketing (1)

- B2B lead generation on LinkedIn (1)

- B2B marketing creative trends (1)

- B2B marketing on LinkedIn (1)

- BWBB (1)

- Blockchain (1)

- Blockchain Technologies (1)

- CTA button (1)

- Design Thinking Model (1)

- Direct Marketing (1)

- Dreamforce 2017 (1)

- Drip Marketing Campaign (1)

- Dynamics 365 (1)

- Dynamics 365 marketing (1)

- Dynamics Marketing (1)

- Eastern Central Europe (1)

- Eastern Europe (1)

- Emotional B2B Marketing (1)

- Employee Feedback (1)

- Event management (1)

- External Marketing (1)

- Facebook Apps (1)

- Facebook marketing (1)

- Freemium SaaS (1)

- Go-to-Market (1)

- Google Ad Grant (1)

- Google Ads statistics (1)

- GoogleAdGrant (1)

- HR planning (1)

- Hubspot Outbound (1)

- IT marketing (1)

- IT outsourcing (1)

- IT service price (1)

- Intel (1)

- LeadGeneration (1)

- LinkedIn B2B marketing (1)

- LinkedIn for business growth (1)

- Machine Learning (1)

- Market Entry Strategy (1)

- Market Research (1)

- Marketing Results (1)

- Marketing frameworks (1)

- Marketing vs Sales (1)

- Marketo (1)

- Medium Companies (1)

- Microsoft Dynamics 365 (1)

- NGO (1)

- Networking (1)

- Organizational culture (1)

- PPC statistics (1)

- PPC stats (1)

- Personalized messages (1)

- Pictures (1)

- Podcast SEO (1)

- Price (1)

- Recruitment Marketing (1)

- Revenue operations (1)

- Romanian content marketers (1)

- SaaS (1)

- SaaS startup growth (1)

- Salesforce Partners (1)

- SharpSpring (1)

- Small Business (1)

- Social Proof (1)

- StopWar (1)

- Tactics (1)

- Target (1)

- Tech events (1)

- Template (1)

- Till Hahndorf (1)

- Types of Google Ads (1)

- Ukraine (1)

- VirginAmerica (1)

- Voice Search SEO (1)

- Work alternative (1)

- Youtube Ads (1)

- ads setting (1)

- app (1)

- artists (1)

- b2b benchmark (1)

- b2b buyer (1)

- b2b buying process (1)

- b2b buying trends (1)

- b2b customers (1)

- b2b marketing vs sales (1)

- b2b modeling (1)

- b2b price (1)

- b2b viral campaign (1)

- benghmarking (1)

- best practices for B2B marketing on LinkedIn (1)

- brand advocates (1)

- business (1)

- business growth course (1)

- buyer behaviour in b2b (1)

- buyer persona template (1)

- buyers (1)

- call to action (1)

- clients (1)

- cold-calling (1)

- company (1)

- competition (1)

- creative marketing strategies for B2B (1)

- customer segmentation (1)

- cybersecuritystrategy (1)

- dan schawbel (1)

- detailed buyer persona (1)

- differentiators (1)

- downloadable resources (1)

- e-mail campaigns (1)

- e-mail message and copy (1)

- employer brand experience (1)

- employer of choice (1)

- environmental marketing (1)

- fans (1)

- gdpr benefits (1)

- gdpr benefits for marketing (1)

- go-to-market channels (1)

- green marketing (1)

- growth marketing (1)

- hotel (1)

- how to find leads (1)

- how to sell (1)

- how to use LinkedIn for B2B marketing (1)

- human resources (1)

- iOS (1)

- inbound marketing services (1)

- inbound marketing vs outbound marketing (1)

- international business (1)

- investment in marketing (1)

- investors (1)

- jamie oliver (1)

- lead generation results (1)

- leads (1)

- letter writing (1)

- like (1)

- market price (1)

- marketing benchmarking (1)

- marketing flywheel (1)

- marketing goals (1)

- marketing investments (1)

- marketing letters (1)

- marketing message (1)

- marketing objectives (1)

- marketing strategy for 2022 (1)

- mobile (1)

- mobile marketing (1)

- music (1)

- new business opportunities (1)

- online reputation (1)

- peak-end rule in B2B marketing (1)

- personal branding tips (1)

- personell issues (1)

- photos (1)

- podcast (1)

- positive employer brand (1)

- ppc click fraud (1)

- price debate (1)

- price negociation (1)

- pricing (1)

- pricing stratey (1)

- product cost (1)

- product price (1)

- promote (1)

- publicity vs persuasion in B2B marketing (1)

- recession tactics (1)

- roadmap (1)

- sales (1)

- script (1)

- seo practices (1)

- service price (1)

- services (1)

- setting objectives (1)

- setting the price (1)

- smart bidding (1)

- social channels (1)

- social media for B2B thought leadership (1)

- social networking (1)

- social recruitment (1)

- startup (1)

- subscribers (1)

- sustainability (1)

- tailored experience (1)

- talent pool (1)

- tech hub (1)

- tech professionals (1)

- thought leadership content (1)

- thought leadership on social media (1)

- tools (1)

- updates (1)

- using characters in B2B advertising (1)

- viral campaignes (1)

- viral marketing (1)

- viral videos (1)

- visual (1)

- voice search optimization (1)

.png)

.png?width=1920&name=Webinar%20B2B%20Marketing%20Strategies%20for%202022%20(5).png)

.png?width=100&name=cover%20blogposts%20sm%20website%20(6).png)

-1.png?width=767&name=NNC%20Blog%20featured%20image%20(16)-1.png)

.png?width=767&name=NNC%20Blog%20featured%20image%20(23).png)

.png?width=767&name=NNC%20Blog%20featured%20image%20(21).png)

-2.png?width=767&name=NNC%20Blog%20featured%20image%20(1)-2.png)

.jpg?width=767&name=NNC%20Blog%20featured%20image%20(2).jpg)